Buyer demand weakens but affordability boost likely

House price inflation is losing momentum as seasonal factors and growing economic uncertainty cools buyer demand, while supply continues to expand. More homes for sale are boosting choice and keeping house prices in check.

House price inflation is set to slow further in the coming months, while sales agreed will continue to increase. We expect lower base rates over 2025 to support market activity. In addition, lenders are starting to adjust how they stress test the affordability of new mortgages. We estimate this could boost buying power by 15-20%, supporting demand and sales agreed rather than boosting house prices.

House price inflation slows to 1.6% as supply expands

Average house prices have increased by 1.6% over the last 12 months to March 2025, down from 1.9% at the end of 2024. House price growth remains higher than the 0.2% recorded a year ago. The average price of a home is £268,000, an increase of £4,270 over the last year.

Buyer demand was running 10% above last year in the early months of 2025, ahead of the end of stamp duty relief in England and Northern Ireland. Demand has cooled in recent weeks and is broadly in line with the levels recorded a year ago.

The weakening in buyer demand is partly seasonal, reflecting the Easter holidays, while global events and uncertainty over the economic impact of tariffs are likely to be causing hesitation amongst some buyers. Sales agreed are holding up 6% higher than a year ago¹.

One area of the market where there is robust growth is in the number of homes for sale. There were 15% more homes listed for sale in the last month compared to a year ago¹. The average estate agent currently has 34 homes for sale, compared to 31 this time last year and a low of 15 in 2022 during the pandemic boom. Many of these sellers are also buyers, which explains why sales agreed continue to increase.

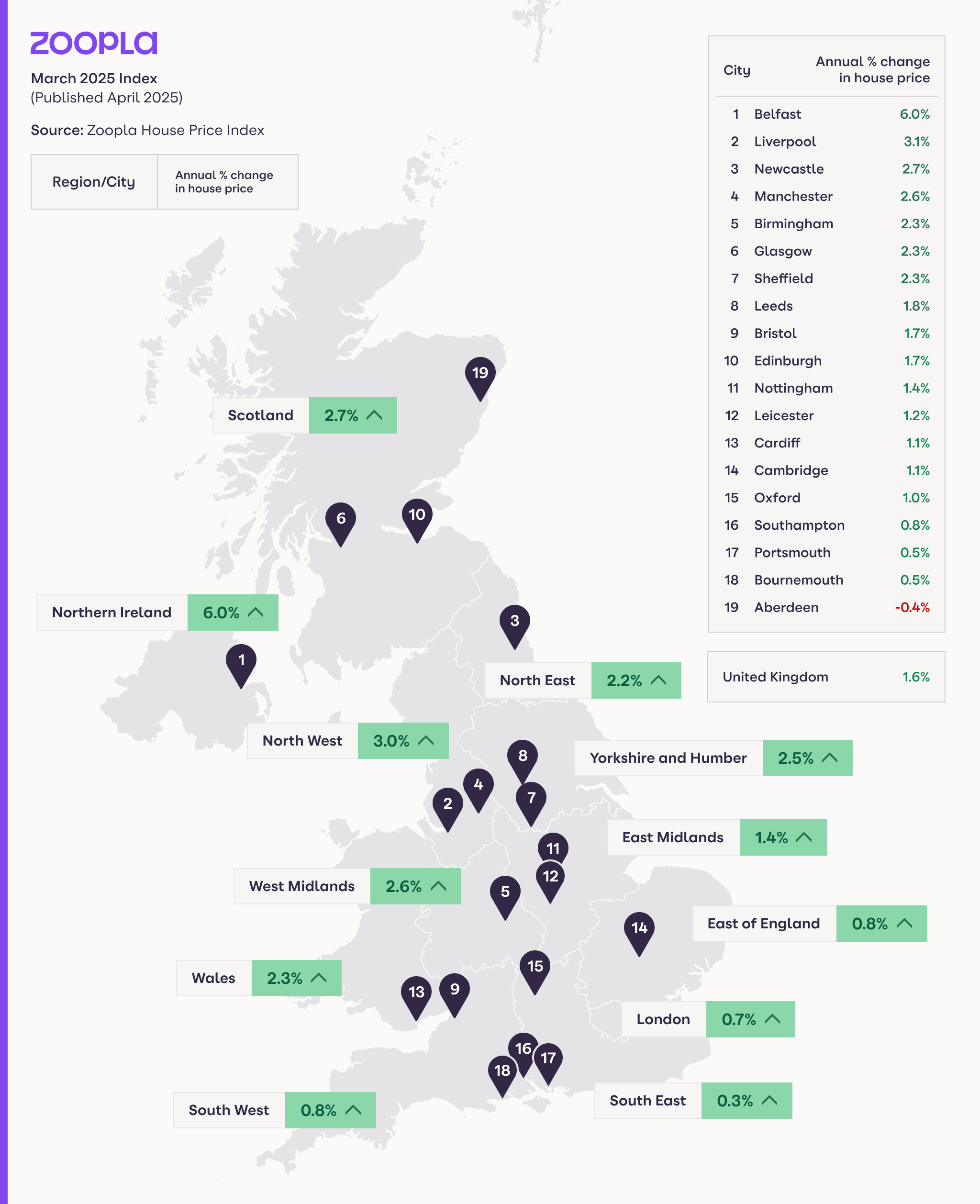

North-south divide in house price inflation

House price inflation is starting to slow across all regions and countries of the UK, mirroring the national trend. However, the current rate of price growth remains higher than a year ago across all areas.

The number of sales agreed is also higher than a year ago across all areas. Sales agreed are up by double digits in Wales (14%), the North West (10%) and the North East (10%). The market needs only modest price rises to support sales activity.

House price inflation is still sitting at less than 1% across southern regions of England where affordability pressures are greatest. House prices in these regions are high relative to household incomes, while the recent end of the stamp duty boost has dampened demand.

In contrast, prices are rising by 2.2% – 3% across the West Midlands, the Northern regions, Wales and Scotland. Prices are 6% higher in Northern Ireland. House prices are lower in these areas, and buying a home is accessible to a greater number of households.

Uncertainty to temper demand in the short term

We expect market activity to continue to track in line with 2024 levels. However, ongoing uncertainty around the impact of tariffs on the UK’s economy will continue to weigh on demand in the coming weeks.

While UK economic growth is expected to be weaker in 2025, growth in average earnings² (5.6%) remains well ahead of general inflation. Current expectations are that the Bank of England may have scope to further lower the UK base rate this year. This would ensure the cost of average fixed-rate mortgage remains in the 4-5% range.

This points to a general continuation of current housing market trends, with steady growth in sales as more sellers come to the market but with house price inflation remaining in check.

Boost to buying power from changes to affordability tests

One emerging trend that we expect to positively support market activity in the coming months is a relaxation in how lenders assess the affordability of new mortgages. While buyers focus on the mortgage rate they will pay, lenders also check whether the borrower can afford a ‘stressed mortgage rate’ at a higher level than the borrower will pay.

While the average 5-year fixed rate mortgage is around 4.5% today, many lenders are currently ‘stress testing’ affordability at 8-9%. This makes it harder to secure a mortgage without a large deposit. If average mortgage stress rates were to return to pre-2022 levels of 6.5% to 7%, this would deliver a 15-20% boost to buying power.

An average first-time buyer with mortgage repayments of £1,020pcm at a 4.5% mortgage rate would typically have to prove they could afford monthly repayments of £1,550pcm at an 8.5% stress rate. If the stress testing is relaxed to 6.5%, repayments would fall to £1,275pcm, boosting buying power. It’s a similar pattern for the average homeowner, while the actual impact will vary by lender and type of borrower.

This change would consequently support demand and sales volumes, helping to clear the stock of homes for sale, rather than boosting house prices. Other existing rules and regulations that remain in place will continue to impact the availability of mortgage finance.

Outlook – slower price growth, more sales

The housing market has been resilient to external forces over the last 2 years and is facing further headwinds. The growth in the number of homes for sale is evidence that there are many homeowners in the market looking to move home, despite wider macro trends.

We expect house price growth to slow towards 1% to 1.5% in the coming months. The market remains on track for 5% more sales in 2025 as long as sellers remain realistic on pricing.

Are you looking at selling your Solihull home? BU Homes is an independent Solihull Estate Agent based in Olton. We will provide you with the best marketing to reach buyers, providing stunning virtual tours, floors plans and professional photography to sellers. We were the 'Gold' winners at the British Property Awards for the Solihull region. Book your free property valuation today.