House price inflation slows as supply grows

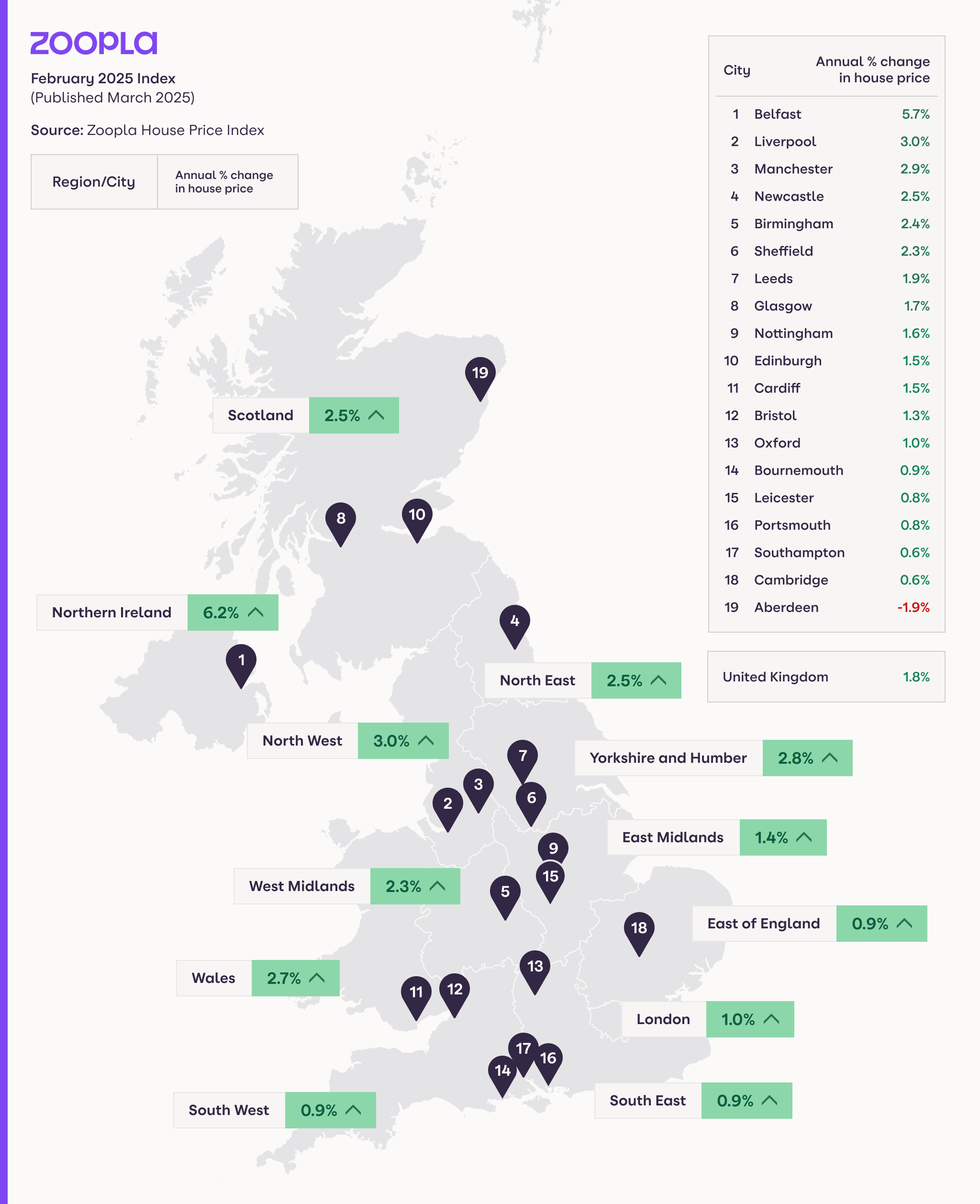

House price inflation is starting to slow after a sustained recovery over the last 12 months. The annual rate of UK house price inflation edged lower in February to 1.8%, down from 1.9% in January. Prices are still rising faster than a year ago (-0.2%) but we expect the rate of UK house price inflation to moderate in the coming months. There are several factors behind the expected slowdown. The number of homes for sale is growing faster than the number of sales being agreed, boosting choice for buyers and re-enforcing a buyers’ market. While house price inflation is slowing, the number of sales agreed continues to increase, up 5% on a year ago, with demand 10% higher. The number of homes for sale is 11% higher than this time last year, and set to keep rising as we enter the spring selling period. Almost 30% of homes are listed for sale between March and May each year.

Concerns over the outlook for inflation mean fewer base rate cuts are expected over 2025. This has reduced expectations that mortgage rates might fall further, which would support household buying power. Average mortgage rates have stabilised in recent months at c.4.4%, up from 4% at the end of 2024. Robust growth in average earnings, up 6% in the last year, is the biggest support for household buying power at present. However, many more buyers are facing higher stamp duty costs from the 1st April, which they will want reflected in the price they pay for a home. In addition to these national factors, the London housing market is also suffering something of a hangover in the wake of the rush to beat the 1 April stamp duty deadline. This has created a lull in market activity, with demand 3% lower over the last year. The impact is more pronounced amongst first-time buyers, hitting price rises in the capital.

Outlook – slower price growth, more sales

We expect the growth in sales agreed to continue rising at a steady pace over 2025 as more sellers, most of whom are also buyers, enter the market in the coming months. House price inflation is set to moderate further as supply grows and the extra costs of stamp duty in England feed through into house prices. A slowing in house price inflation is not a major concern although the market needs some growth in prices to encourage sellers to come to market and buyers to make realistic offers on homes for sale. There is plenty of demand for homes but also lots of choice. Households looking to sell their home in 2025 need to be careful in how they set their asking price to attract sufficient demand to agree a sale. It’s important to seek the advice of local estate agents to inform the most suitable pricing strategy for every home.

Are you looking at selling your Solihull home? BU Homes is an independent Solihull Estate Agent based in Olton. We will provide you with the best marketing to reach buyers, providing stunning virtual tours, floors plans and professional photography to sellers. We were the 'Gold' winners at the British Property Awards for the Solihull region. Book your free property valuation today.