Record number of sellers in promising start to 2025, but uncertainties ahead

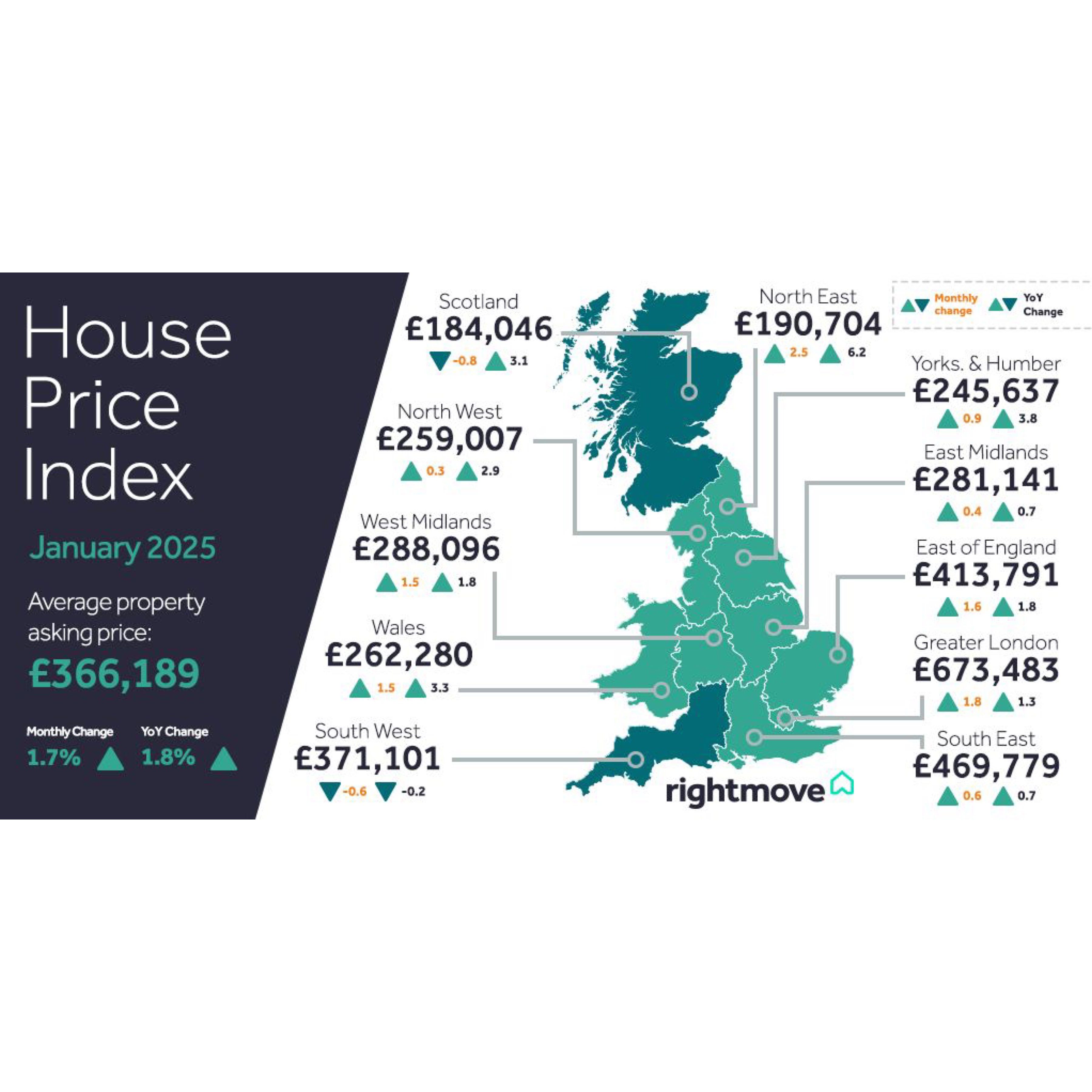

• The average price of property coming to market rises by 1.7% (+£5,992) this month to £366,189, the largest jump in prices at the start of the year since 2020:

o New seller asking prices are still nearly £9,000 below May 2024’s record, reflecting buyer affordability constraints

• A record number of early-bird new sellers have come to market since Boxing Day, giving buyers the highest level of choice at the start of a year since 2015, which has also contributed to an encouraging start to 2025 buyer activity:

o The number of new properties coming to market is 11% ahead of the same start-of-the-year period last year

o The number of buyers contacting agents about properties for sale since Boxing Day is 9% ahead of last year, and the number of sales being agreed over the same period is up by 11%

o Rightmove has recorded its busiest start to a year for Mortgage In Principle applications, evidence of buyer intent

• However, despite the promising start to 2025 there are uncertainties ahead, including the pace and number of interest rate drops and the impact of the stamp duty deadline on 31st March

• Mortgage rates remain sticky, blocking many buyers from significant affordability improvements:

o Rightmove’s weekly mortgager tracker shows that the average five-year fixed mortgage rate is now 4.75% compared with 4.78% at this time last year

The average price of property coming to the market for sale rises by 1.7% this month (+£5,992) to £366,189. This is the largest monthly jump in prices at the start of the year since 2020, as new seller asking prices bounce back from the usual seasonal fall in December and begin 2025 with some new year optimism. Average asking prices are still £8,942 below May 2024’s peak, reflecting buyer affordability constraints. However, with a record number of early-bird new sellers coming to market from Boxing Day and into January, there seems to be pent-up demand to move. The number of new properties coming to market is 11% ahead of the same period at the start of last year, while the average number of homes for sale per estate agency branch is currently at the highest for this time of year in 10 years. High buyer choice has contributed to increases in buyer enquiries and sales agreed compared to a year ago, but also means fierce seller competition to attract these new year buyers. Some sellers may find that they have been too optimistic on their initial pricing and get left on the shelf in favour of more competitively priced neighbours.

Buyer activity is also starting the year encouragingly, as many festivity-distracted buyers return to make their move happen. Since Boxing Day, the number of buyers contacting estate agents about homes for sale is up by 9% on the same period last year. The combination of good choice and healthy buyer demand has kept the sales trend positive, with the number of sales being agreed between buyers and sellers now 11% ahead of this time last year. Rightmove has also recorded its busiest start to a year for prospective home-movers applying for a Mortgage in Principle to understand what they may be able to borrow from a lender, which is evidence of future buyer intent. All of these very early lead indicators at the start of this year point to a busier 2025. Rightmove forecasts a larger number of transactions this year of 1.15 million, and an average asking price increase of +4%.

However, despite many positive activity metrics when compared with last year, there are uncertainties ahead, including the pace and number of future interest rate drops and the impact of increased stamp duty for many home-movers from 1st April. One market sector that Rightmove anticipates will be particularly affected is the smaller-homes, typical first-time-buyer sector. Since Boxing Day, the number of enquirers in this sector is up by 8%, the lowest increase of all market sectors. First-time buyers in cheaper parts of England will largely be unaffected. However, stamp duty charges rising for those buying above £300,000 will be a drag on the important bottom-of-the-ladder market in more expensive areas, unless some additional help for first-time buyers is announced soon.

Mortgage rates remain at unexpectedly high levels, which means that many buyers are not seeing significant affordability improvements. Rightmove’s weekly mortgage tracker shows that the average five-year fixed mortgage rate is now 4.75% compared with 4.78% at this time last year. While the average two-year fixed mortgage rate has improved, it is still 4.97%, down only slightly on last year’s 5.08%. There have been changing messages on how many Bank Rate cuts to expect this year, which are causing some uncertainty and will prevent some potential buyers from joining in the new year enthusiasm.

BU Homes are the leading, independent Solihull Estate Agent. We are a friendly, passionate team of local Solihull and South Birmingham property experts, based in Kineton Green Road in Olton, Solihull. Selling your home? Contact us for a free valuation today.